- Details

- Geschrieben von: Rashmi Raj

- Kategorie: Blog

WORKING IN GERMANY: THE REQUIREMENTS

To work in Germany, you must have either a residence permit and a work visa. Everyone who has work and residence permit from German authorities are eligible to work in Germany. But there are some rule and restriction for some categories of applicants about their nationality and some agreements which needs to be signed between Germany and the respective country.

Eligible foreign workers are divided in three major categories:

EU, Switzerland and EEA Nationals

Applicants of this category don't have to worry about visa, you don't need a visa, work or residence permit to stay and work in Germany. You just have to register your residence once you are in Germany, using a passport or valid ID.

Shorter than three months

After you register your German address with the local municipality, you have freedom to work, stay and move in Germany for 3 months.

Longer than three months

After 3 months, if you plan to stay longer, you need to apply for a certificate of residence. Once you receive the certificate, you can stay in Germany as long as you want. Certificate might be dated as your employment contract, but it can be easily extended.

Nationals of Australia, Canada, Israel, Japan, Republic of Korea, New Zealand, and USA

People from these countries don't need a visa to entre Germany, nor do you need to have a job offer to come to Germany. However, if you want to stay you must register yourself at the foreigners office go get a residence permit. You also need to seek a work permit as soon as you reach to Germany to legally work in Germany.

Non-EU Nationals

People of this category need to apply for visa before coming to Germany, applicants are suggested to take a right type of visa depending on the purpose of vising in Germany. In order to get visa you need to provide proof that you have a job offer from a German company or institution. After you are Germany you need to apply for work and residence permit in Germany.

Temporary residence visa

This is a limited residence permit which allows you to stay in Germany usually for one year. But you can extend this permit if you fulfil all the requirements. This is the most common visa among the foreign national.

Self-employed visa

If you are planning to open your own business in Germany, there is a specific visa for you with some extra requirements. You need to get a special visa before you start working with your business.

Permanent settlement permit

This is a visa for those who wants to settle in Germany permanently, to apply for this visa you have to prove that you have worked in Germany for at least 5 years. After you have been in Germany for 5 years, you can apply for a permanent residence.

- Details

- Geschrieben von: Rashmi Raj

- Kategorie: Blog

SOCIAL SECURITIES FOR EMPLOYEES IN GERMANY

Germany has a high level of income tax, which is justified by the fact that the government gives you a lot of social benefits. As a German employee you need to contribute 20% of your income to social security fund.

The total amount of social contribution per month is 40.45% of gross income, 19.425% is paid by employees and 21.025% by employers.

Germany has the second-highest social security contribution for a single person in the EU.

HEALTH INSURANCE

All the employees in Germany are enrolled in a public health insurance fund by the employers. Every employee in Germany are obliged to have a health insurance.

Ninety percent of people in Germany have public health insurance, which include vision, dental, pre and antenatal and pediatric care. People prefer public insurance because unemployed spouses and children under 25 are co-insured at no additional cost. Private health insurance is only available for the employee earning than a threshold (64,350 EUR annually for 2021).

Both public and private health insurance covers most basic services by the doctor and treatments, but if you want some special unnecessary medical care or you want a private hospital room, you will have to take an additional private healthcare plan. In both cases, the contributions are shared equally by the employer and the employee.

| Paid by Employee | Paid by Employer | |

|---|---|---|

| Health Insurance | 7.3% | 7.3% |

DISABILITY INSURANCE

People can donate in states disability fund, which helps people with disabilities continue in the workforce. Donation provides them with the income when they are no longer able to function. People with natural disabilities, war veterans and victim of violent crimes are all covered by this disability fund.

RETIREMENT INSURANCE

In Germany retirement compensation starts from the age of 65 for the people born before 1947 and 67 for those born after 1964. All the employees and also some self-employed are compulsorily insured for pension by law.

All the employee will get the pension after reaching the official German pensionable age even if they move to some other country legally, if they have worked and paid contribution in Germany for more than 60 months (5 years). It is usually divided equally between an employee and employer.

| Paid by Employee | Paid by Employer | |

|---|---|---|

| Retirement Insurance | 9.53% | 9.53% |

UNEMPLOYMENT INSURANCE

Every employee should be protected by unemployment insurance in case someone loses the job. You will be contributing in unemployment fund, while you are employed. Employees can use the benefit of this insurance after working and paying at least 12 months in the last two years. The amount you get and how long you will get this benefit depends on your age and your employment time.

| Paid by Employee | Paid by Employer | |

|---|---|---|

| Unemployment Insurance | 1.5% | 1.5% |

ACCIDENT AND SICK PAY INSURANCE

This insurance protects you when fall sick or if you are injured in an accident while working, which is paid in full amount by the employer.

The payments cover all the cost of the treatment and recovery, invalidity pensions and also funeral costs in the event of death.

| Paid by Employee | Paid by Employer | |

|---|---|---|

| Accident Insurance | 0% | 1.6% |

- Details

- Geschrieben von: Rashmi Raj

- Kategorie: Blog

BENEFITS OF WORKING IN GERMANY

Germany is a developed company with fast-growing economy, and a great economy means great opportunities. There are numerous opportunities in IT, Engineering, and Manufacturing sector, and above all German government is consistently working to bring foreigners into the workforce, which is a great benefit especially for the people from less or under developed countries.

Some attractive employee benefits

1. Average Salaries

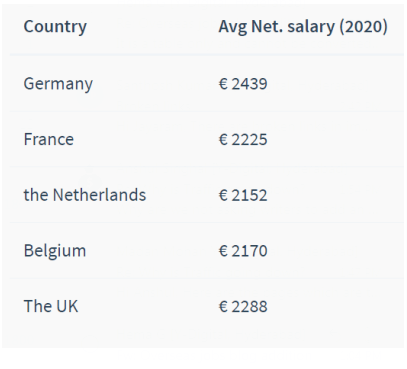

The salaries can vary based on the industry, region and size of the company. According to Stepstone an online job portal, the average salary in Germany comes to about 58.800 Euros. Another report by an online job portal XING, the annual salary is 70.754 Euros including bonuses, holiday and Christmas allowances. As of 2020 the minimum wage was 9.35 Euros per hour. When compared to other countries in Europe, the average salary in Germany in higher:

2. Work-life Balance

German companies strictly follow the rule of working five days in a week, by which employees gets to spend time with their families and can indulge in other activities. The employees are not under pressure to work extra hours or to work on non-working days. Moreover, some companies also give freedom of flexible working hours. In Germany employees are not expected to work extra but should work productively.

3. Required and Provided Leaves

Sickness and Disability Leave

The employer in Germany have to continue paying employees who are on sick leave. Salaries continue to be paid to those who work legally in an event of sickness or any accident. The employer is entitled to continue the payment for a duration of six weeks.After working for six months in a company, a severely disabled employee may claim additional vacation, based on a five-day-week.

Maternity and Paternity Leave

The female employees are continued to paid during maternity leave, for the time period of 6 weeks before and 8 weeks after giving birth. The maternity leave can be extended to 12 weeks in case of multiple births, premature births and disabled children.After the birth of child, both female and male employees are provided maximum 3 years of parental leave per child, but employers are not obliged to pay to the employees during this period. After the expiry of parental leave, employees can return to their previous position.

Holidays and Vacation Leave

The number of public holidays vary from one federal state to other in Germany, in some states like Berlin and Lower Saxony public holiday is minimum 10, and in some states like Bavaria and Saarland public holiday is 12. The companies in the tech industry in Germany provide 20 to 30 days of vacation leave to all the employees based on status and seniority.

4. High Demand for Skilled Expats

German is the economic powerhouse of the Europe, that means the country runs on the workforce. Skilled IT workers are required in almost every company in any sector of Germany. Automotive engineering, Electrical Engineering, Structural Engineering, Computer science, Mechanical Engineering, Telecommunications, Medical Professions and Mathematics Information Technology(MINT) are some other sectors in which skilled expats are highly required.

- Details

- Geschrieben von: Rashmi Raj

- Kategorie: Blog

BENEFITS OF FREELANCING IN GERMANY

Freelancing gives you control over your lives, the time you want to spend working and the volume of the work you want to do. There are no specific rules and condition. You don’t have to work nine to five, you can focus on your life outside the work easily, you will be more productive as you can do multiple things at once, doing multiple works at the same time you will make more money, as a freelancer you can also save on your travel expense.

As a freelancer in Germany, you don’t have to register with the Business Registration Authority in Germany, and you also required to pay fewer taxes than other self-employed.

Common benefits for freelancers in Germany

1. Command over work

The biggest benefit of being a freelancer is you are the CEO of your own company, being the Boss you don’t have to answer to anyone but your client and yourself, you have control over your job and workload, you make all the decisions on your own.

2. Freedom of choosing potential clients

As a freelancer you are free to choose the kind of clients and people you want to work with, when you work for someone you don’t get choice of who you work with, you can get stuck with unprofessional clients.

Germany has a great economy, some cities like Düsseldorf and cologne have a strong media and publishing business, these cities including more other cities in Germany has heaps of big to mid-sized businesses. Businesses are encouraged in Germany, so it is obvious to get good clients in almost every city of Germany.

3. Multiple income sources

A major benefit for freelancers is they can work with multiple clients and projects at the same time, there is no law that restricts you for taking up as many projects as you want and can work with them simultaneously.

Few experienced freelancers have polished their skills and make six figures per month by working for a bunch of projects at the same time.

Germany clients know that the taxes and other costs are relatively high in Germany, they are prepared to pay high prices to the freelancers, freelancers have the freedom to charge higher rates than the average rates or fixed rates. Well established freelancers charge a high rate and progressively Increase their income.

4. Flexible work life

Workers from all around the world are opting for a flexible work style, some even switching companies which offers flexible schedule, with freelancing you can work from wherever you prefer. You get to choose your own hours; you don’t have to wait for weekends to give time to your personal life.

You can work from wherever you want to, be it a local coffee shop, or while you are at home, or even while you are on vacation.

Other than these benefits freelancers also get some benefits from the country, even though you have to pay high tax rates in Germany, as a freelancer you are entitled to several tax benefits, by adding number of expenses as business expenses and reduce your taxes. The country also gives financial support to the freelancers during national emergencies.

- Details

- Geschrieben von: Rashmi Raj

- Kategorie: Blog

FREELANCING IN GERMANY

In Germany, a freelancer is defined as a person who exercises the free professions independently, without functioning as a business, partnership, or being employed with a full-time, part-time or remote contract. The country has updated its laws and created rules so that freelancers would also be included and calculated in country’s work system, the country has opened its doors to foreigners that want to move to Germany and work as a freelancer, while freelancing is simplest of working, in order to move to Germany to work as a freelancer he or she must meet the rules of the German Federation.

Freelancers VS regular employees in Germany

An employee has to register as an employer and pay social security, income tax and employer liability. At the same time the employ will benefit from protection for termination. Freelancers, on the other hand, are not protected from termination and have to take care of health insurance etc. by themselves. Also, while an employee will receive their salary on a regular basis, a freelancer needs to first provide proper invoices in order to get paid.

Opportunities for freelancers in Germany

Types of freelance jobs in Germany:

- SAP

- Business consulting and Management

- IT

- Engineering

- Development

- Graphic Design, Content, and Media

Freelancing marketing in Germany

According to a survey of freelancer-kompass-2020, The best type of freelancing jobs in Germany are in IT and Technology sector, the average hourly rate for these type of freelancers in 2020 was EUR 94.28.More than half (57%) of IT freelancers earned a gross income (before taxes) of over EUR 100.00, after taxes, 57% of freelancers earned a net income of over 50.000.Furthermore, almost 31% of freelancers earn between EUR 5.000 – 7.000 per month net salary.

Top 5 Major challenges freelancer faces

According to a survey of freelancermap.com 2020, these are the major challenges and freelancing problems:

- Landing clients - About 68% of freelancer chose landing clients as the biggest issue in their career.

- Work-life balance - Nearly, one-third of the freelancer struggle with their work-life balance.

- Getting better pay rate - Many freelancers faces problem in increasing their pay rate. Many freelancer jobs are part of the competitive markets, which means there are a lot of people trying to undercut your prices.

- Staying productive - More than 15% of the participants said they struggle most with maintaining productivity.

- Accounting - Freelancing involves a lot of paperwork and requires time to manage invoices, chase payments, submitting taxes. Accounting in particular, was cited as a big challenge for 21% of freelancers.

Paying Taxes as a freelancer

Freelancers are exempt from paying Trade Taxes in germany they are still subjected to pay Income Tax and Value Added Tax:Income Tax. Germany has a base rate of 14% of the income tax, which can go up to 42%. A surcharge of 5.5% is also included in this tax. Freelancers will need to pay this tax on a quarterly basis. Those making less than EUR 9.169 are exempt from the income tax.Value Added Tax. Freelancers need to prepare VAT declarations periodically, declaring their revenue. Freelancer usually pays 19%, but it could be as low as 7% depending on the services.

Getting Health Insurance in Germany

Health Insurance is mandatory for every person moving to Germany, including freelancers. Freelancers have the opportunity to choose whether they want to take public or private health insurance, but it is bit trickier for freelancers, while those are not freelancer or self-employed usually pay half of their insurance and freelancers have to pay all their insurance on their own.